Trading Macro

– A limited knowledge of Monetary

Policy can be fatal

17 JAN 2019 | Careers

Amir Khadr - Head of Technology

Trading is a difficult business. It is difficult to be consistently good at it because by its very nature there is always uncertainty about the outcome of every single trade you ever make. We simply can’t predict the future. Therefore, my experience has taught me that it is essential to create some order to the chaos by operating with a defined process that gives you at least some rigid anchor point that you can rely.

My process:

Do I want to buy or sell? Create a directional bias by assessing the macro fundamental economic conditions. My career has taught me that the single biggest driving force on the price of any large financial market are the fundamentals. A huge portion of the retail trading community trade financial assets without understanding the fundamentals underpinning price behaviour and ultimately this is one of the key factors that leads this community to fail.

What price do I want to buy or sell at? Build a technical analysis framework that defines what prices you are going to be buying and selling at.

Execute the actual strategy you have created. All too often traders create a plan only to then veer off course and end up making trades their analysis did not identify. Emotional factors are normally to blame with you decision making process disrupted by things like the irrational fear of loss.

Review what you did. It is crucial that you take time to review your trade after the event. It doesn’t matter if the trade was profitable or you took a loss – review the strategy and how you implemented it to identify mistakes.

Repeat the process. Learn from the information gathered from previous processes and tweak your process slowly optimising it each time. Implement this process with discipline – the mindset should be that it is not about the P&L, it is about the accurate implementation of your process. A process that slowly and incrementally improves over time.

Here in this blog I would like to outline the importance of the first part of this process. Understanding the fundamentals. Being able to assess economic conditions and how investors are viewing the future outlook for economic growth. Ultimately, the price of all assets (equities, exchange rates, bond yields, commodity prices) are controlled by how quickly or slowly economies are growing. These are the forces that govern supply and demand.

I would argue strongly that in the last decade the single biggest influencing force on the performance of economies (and therefore the performance of financial markets) has been central banks and the unprecedented use of their monetary policy tools such as interest rates and quantitative easing. When it boils down to it, unless you understand the complex world of the US Federal Reserve, the European Central Bank and the Bank of England then you have very little chance of being able to judge how asset prices will behave over the short, medium and long term.

My process:

Do I want to buy or sell? Create a directional bias by assessing the macro fundamental economic conditions. My career has taught me that the single biggest driving force on the price of any large financial market are the fundamentals. A huge portion of the retail trading community trade financial assets without understanding the fundamentals underpinning price behaviour and ultimately this is one of the key factors that leads this community to fail.

What price do I want to buy or sell at? Build a technical analysis framework that defines what prices you are going to be buying and selling at.

Execute the actual strategy you have created. All too often traders create a plan only to then veer off course and end up making trades their analysis did not identify. Emotional factors are normally to blame with you decision making process disrupted by things like the irrational fear of loss.

Review what you did. It is crucial that you take time to review your trade after the event. It doesn’t matter if the trade was profitable or you took a loss – review the strategy and how you implemented it to identify mistakes.

Repeat the process. Learn from the information gathered from previous processes and tweak your process slowly optimising it each time. Implement this process with discipline – the mindset should be that it is not about the P&L, it is about the accurate implementation of your process. A process that slowly and incrementally improves over time.

Here in this blog I would like to outline the importance of the first part of this process. Understanding the fundamentals. Being able to assess economic conditions and how investors are viewing the future outlook for economic growth. Ultimately, the price of all assets (equities, exchange rates, bond yields, commodity prices) are controlled by how quickly or slowly economies are growing. These are the forces that govern supply and demand.

I would argue strongly that in the last decade the single biggest influencing force on the performance of economies (and therefore the performance of financial markets) has been central banks and the unprecedented use of their monetary policy tools such as interest rates and quantitative easing. When it boils down to it, unless you understand the complex world of the US Federal Reserve, the European Central Bank and the Bank of England then you have very little chance of being able to judge how asset prices will behave over the short, medium and long term.

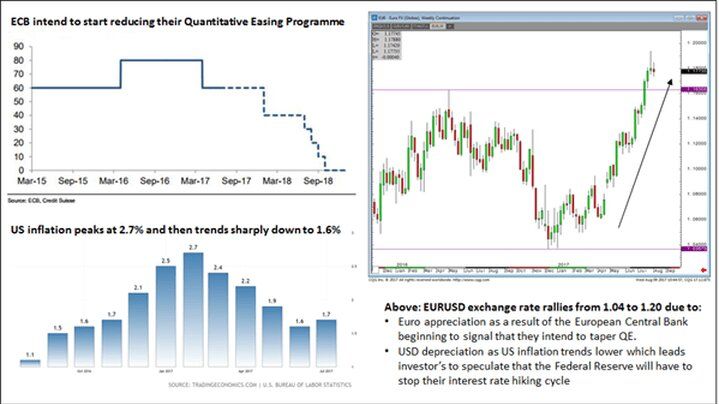

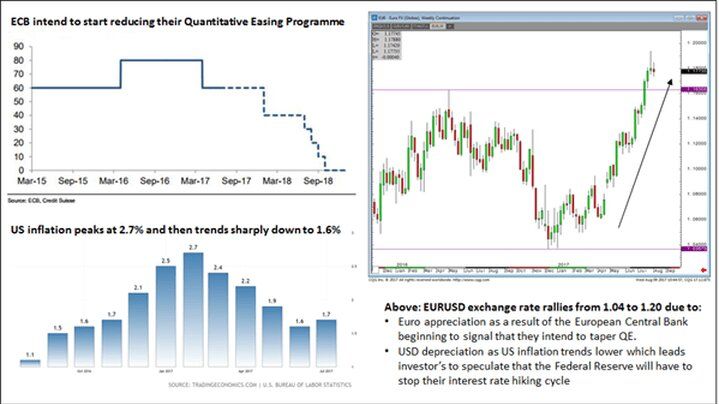

Example 1: The biggest move in EURUSD in 2017 was due to investor expectations about the future actions of the Fed and ECB changing.

Developed economy central banks radically reduced interest rates to record lows in the emergency action taken to try and rescue the global system from the ravages of the financial crisis that started in 2008. Central banks also printed unprecedented amounts of new money to flood the system with liquidity and devalue their currencies. The severity of the crisis has meant that this radical monetary stimulus has had to remain in the system for almost a decade and this has had a radical effect on asset prices.

For example, US equity markets are now nearly 60% higher than they were prior to the crisis in 2007 even though the economy has grown less than 30%. Global yields have dropped to zero, and in some cases below zero which effectively means some entities get paid to borrow money. Exchange rates have seen some of the largest volatility events in history for example Sterling dropping to a 35 year low following the Brexit vote.

Developed economy central banks radically reduced interest rates to record lows in the emergency action taken to try and rescue the global system from the ravages of the financial crisis that started in 2008. Central banks also printed unprecedented amounts of new money to flood the system with liquidity and devalue their currencies. The severity of the crisis has meant that this radical monetary stimulus has had to remain in the system for almost a decade and this has had a radical effect on asset prices.

For example, US equity markets are now nearly 60% higher than they were prior to the crisis in 2007 even though the economy has grown less than 30%. Global yields have dropped to zero, and in some cases below zero which effectively means some entities get paid to borrow money. Exchange rates have seen some of the largest volatility events in history for example Sterling dropping to a 35 year low following the Brexit vote.

Example 2: Short term trade with the strategy based on comments made by BoE Governor Mark Carney.

What is certain in my mind is that monetary policy will continue to be the dominant force on economies and therefore financial markets for the next decade. Having a strong knowledge about things like interest rate hiking cycles, QE tapering, Hawks vs Doves, the Federal Reserve dot plot matrix and the Bank of England’s Quarterly Inflation Report will mean you will be armed to take advantage of the largest market movements and the biggest trading opportunities out there. In contrast, not knowing about this stuff can be fatal…

What is certain in my mind is that monetary policy will continue to be the dominant force on economies and therefore financial markets for the next decade. Having a strong knowledge about things like interest rate hiking cycles, QE tapering, Hawks vs Doves, the Federal Reserve dot plot matrix and the Bank of England’s Quarterly Inflation Report will mean you will be armed to take advantage of the largest market movements and the biggest trading opportunities out there. In contrast, not knowing about this stuff can be fatal…

The Market Maker daily

e-newsletter and weekly podcast

99% said it helped them gain better knowledge of markets

99% said it helped them gain better knowledge of markets  70% said it helped them prepare for a job interview

70% said it helped them prepare for a job interview  Top 5% most followed podcasts globally

Top 5% most followed podcasts globally  Top 5% most shared globally in 2022

Top 5% most shared globally in 2022  Listened to in 84 countries world-wide

Listened to in 84 countries world-wide

Useful Links

EMPLOYERS

UNIVERSITIES

Contact

Sign up to our e-newsletter for the latest market news and careers support.

Sign up to our e-newsletter for the latest market news and careers support.

© Amplify Trading LTD (REG NO: 06798566) VAT: GB947568566. Registered England and Wales.

Useful Links

STUDENTS

EMPLOYERS

UNIVERSITIES

Contact

-

Amplify Trading, 18 St Swithlin’s Ln, London EC4N 8AD

-

+44 (0) 203 372 8415

+44 (0) 203 372 8415

-

info@amplifyme.com

info@amplifyme.com

Sign up to our e-newsletter for the latest market news and careers support.

© Amplify Trading LTD (REG NO: 06798566) VAT: GB947568566. Registered England and Wales.