THE MACRO MENU: 30 MARCH - 3 APRIL 2020

29 MAR 2020 | Careers

Amir Khadr - Head of Technology

MARKET BRIEFING: Monday 30th March 2020

THE WEEK AHEAD: 29th March 2020

Last week ended in a fairly indecisive way with market participants unsure on whether a bottom in the recent stock market rout has been found or is there worse yet to come?

Relying on traditional market indicators as a means to identify a bottom is becoming increasingly difficult. The lack of liquidity and the nature of the subject matter being heavily weighted to the behavioural perception of the virus, makes it a tricky subject to nail down with any kind of accuracy.

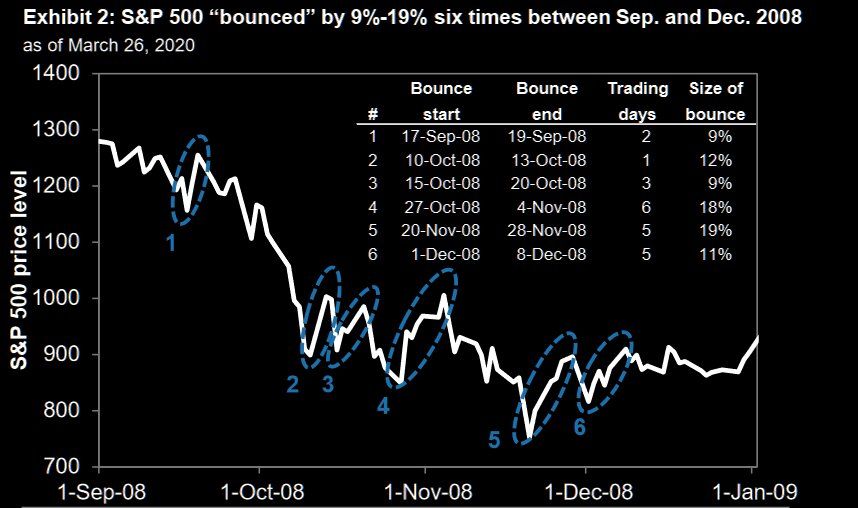

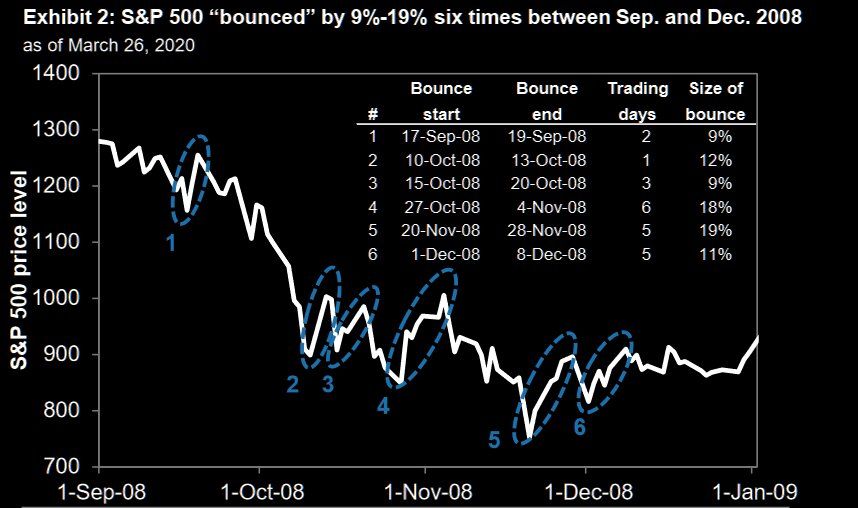

Here's an interesting graphic via Goldman Sachs looking at the bear market rallies observed during the Global Financial Crisis.

Last week ended in a fairly indecisive way with market participants unsure on whether a bottom in the recent stock market rout has been found or is there worse yet to come?

Relying on traditional market indicators as a means to identify a bottom is becoming increasingly difficult. The lack of liquidity and the nature of the subject matter being heavily weighted to the behavioural perception of the virus, makes it a tricky subject to nail down with any kind of accuracy.

Here's an interesting graphic via Goldman Sachs looking at the bear market rallies observed during the Global Financial Crisis.

When reading various banks' research this weekend it largely reflects the degree of uncertainty, with forecasts for the near-term economic future as wide as I've seen at any point in my career. Therefore, my suggestion would be to not place too much weight behind any one call.

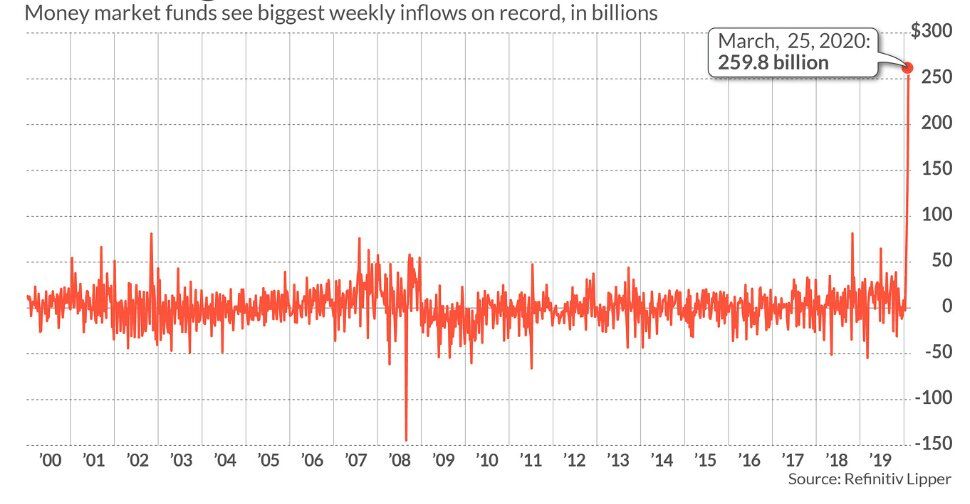

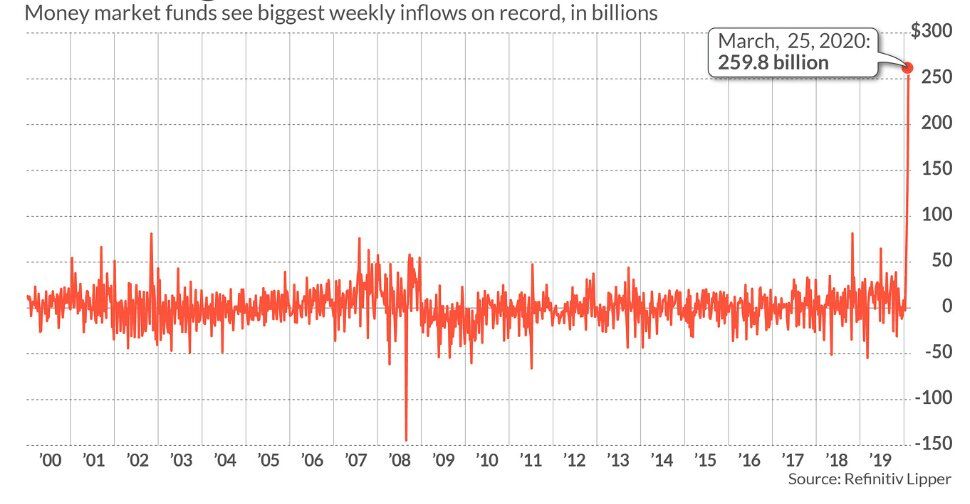

As we've seen in the most recent Refintive Lipper report, this sentiment has been evident in money market funds seeing the biggest weekly inflows on record, marking the third straight week of record highs as investors seek the safest option for now and await to redeploy their capital when greater clarity emerges.

As we've seen in the most recent Refintive Lipper report, this sentiment has been evident in money market funds seeing the biggest weekly inflows on record, marking the third straight week of record highs as investors seek the safest option for now and await to redeploy their capital when greater clarity emerges.

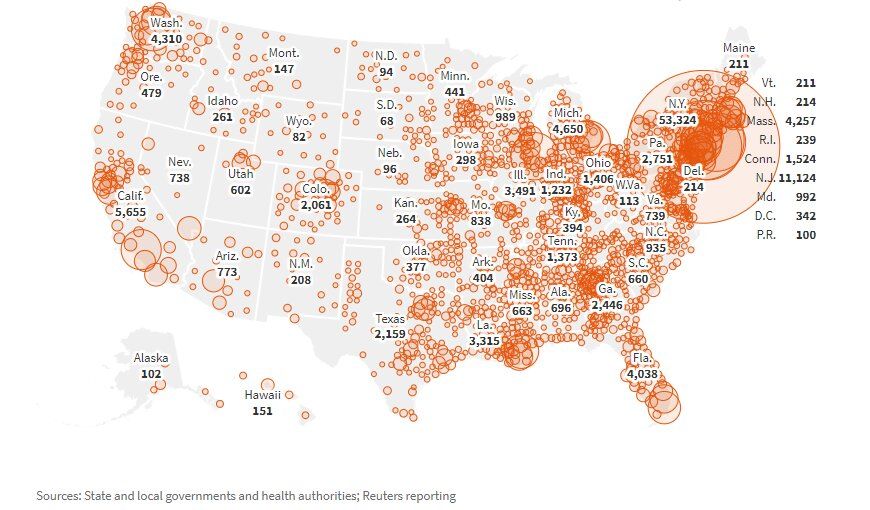

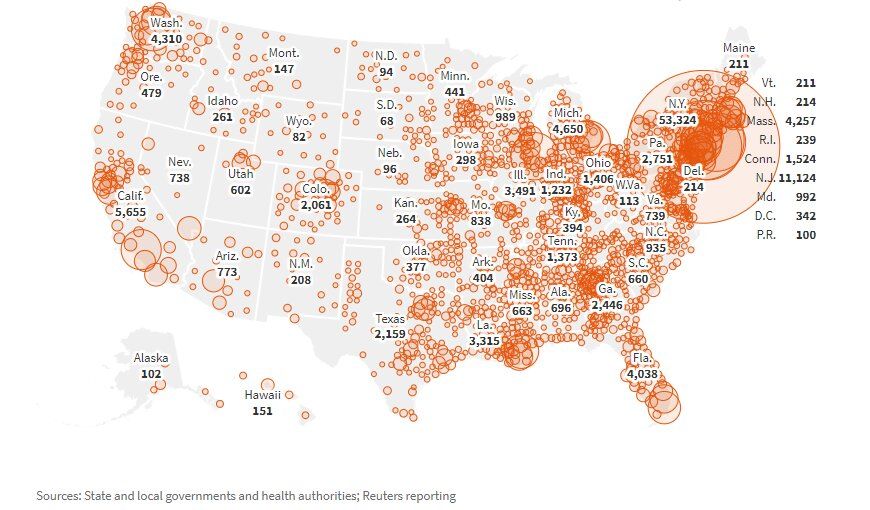

This week should be key to answer these important questions for traders and investors alike as confirmed cases in the US are likely to multiply into the 100,000s resulting in the full quarantining of a number of hot spot areas (New York, New Jersey, Connecticut).

This economic reality will be a decisive moment as to ascertain just how much markets have priced in the impact on the US economy at this point, and despite Trump's resistance this weekend his hand will be forced by the inevitable rise of the death toll.

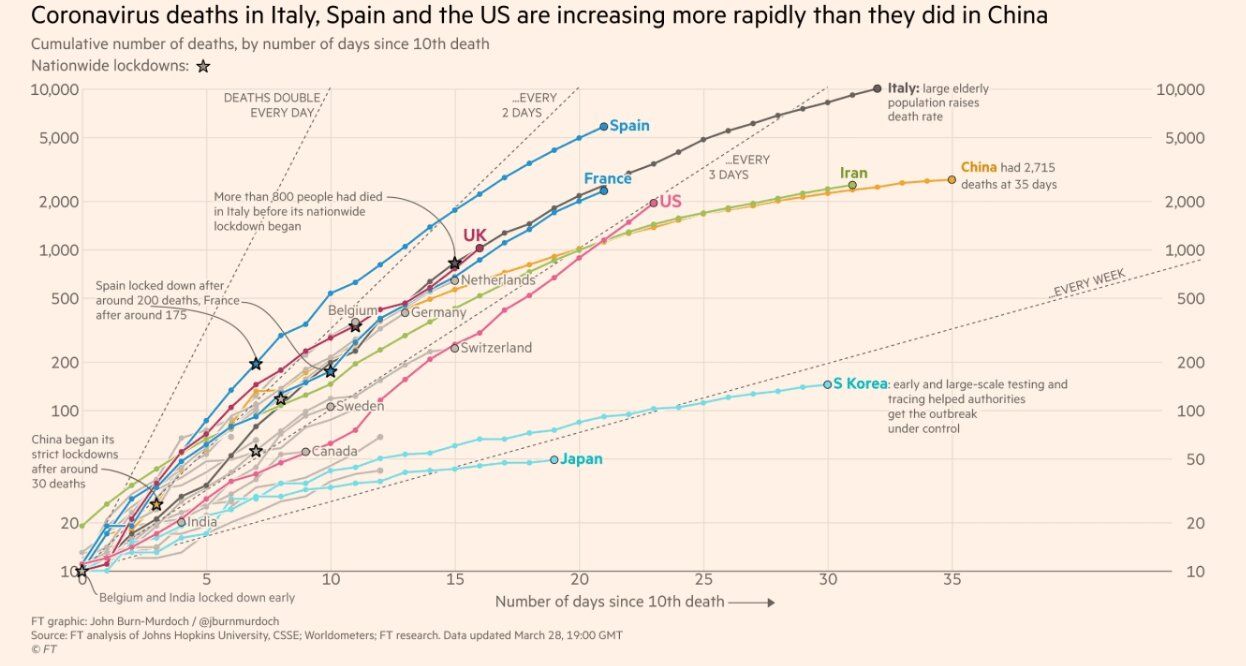

Elsewhere, Germany is set to remain on lockdown to at least the 20th April, according to the health minister and although the UK government remains reluctant to specify the time frame of the lockdown, various medical professors have stated measures being kept in place until June, which I think is a conservative estimate given the hasty withdrawal of measures risks a potential second wave of contamination.

Elsewhere, Germany is set to remain on lockdown to at least the 20th April, according to the health minister and although the UK government remains reluctant to specify the time frame of the lockdown, various medical professors have stated measures being kept in place until June, which I think is a conservative estimate given the hasty withdrawal of measures risks a potential second wave of contamination.

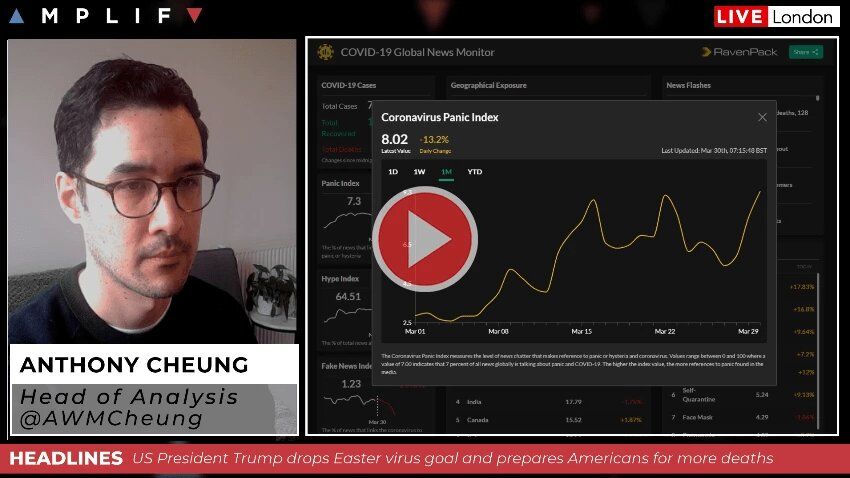

One interesting measurement I am watching at the moment is the Ravenpack 'Panic Index', which measures the level of global news chatter that makes reference to panic or hysteria and coronavirus.

As of today, the index rose over 17% as the death tolls continue to mount. It is this very cycle of polarised news reporting that in turn is feeding consumer apprehension and thus magnifying the economic impact, so the index could prove a useful piece of alternative data and perhaps a telling sign given its move back to a weekly high.

As of today, the index rose over 17% as the death tolls continue to mount. It is this very cycle of polarised news reporting that in turn is feeding consumer apprehension and thus magnifying the economic impact, so the index could prove a useful piece of alternative data and perhaps a telling sign given its move back to a weekly high.

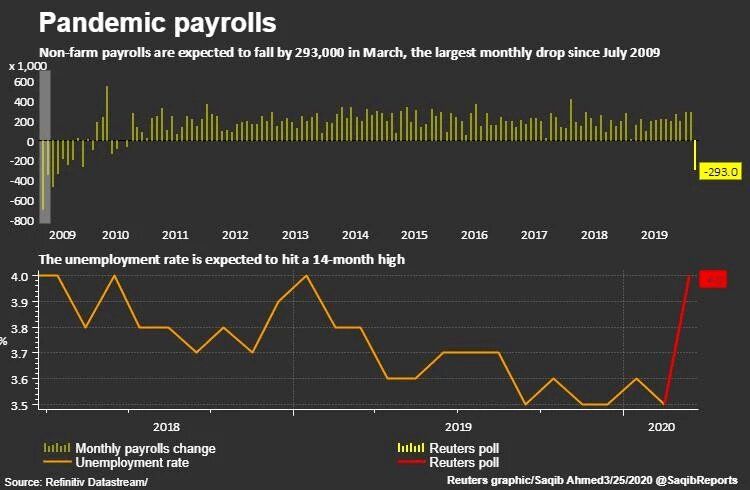

As we discussed in The Macro Menu last week, the latest US jobless claims figures were always going to be record breaking, but perhaps more a case of 'an expected reality materialising' than necessarily new information.

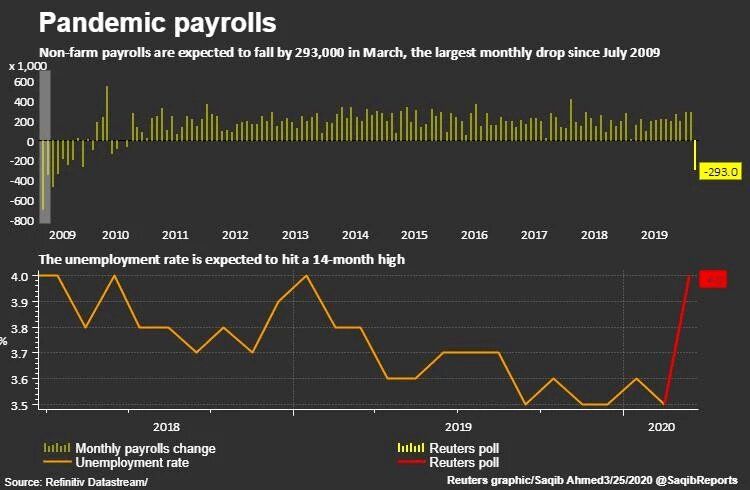

This week we get the release of US non-farm payrolls and in some ways I actually think this data is even less important for markets despite the fact that economists are forecasting payroll data to show a loss of 293,000 jobs - the largest monthly drop since July 2009.

This week we get the release of US non-farm payrolls and in some ways I actually think this data is even less important for markets despite the fact that economists are forecasting payroll data to show a loss of 293,000 jobs - the largest monthly drop since July 2009.

The main reason for this view is the survey period in which the data represents and what amount of layoffs it would have captured at the time of completion. In this instance last week's 3.28mln jobless claims is unlikely to be reflected in the number, so in essence the BLS report is already outdated and therefore of little use beyond that of tabloid newspapers.

This isn't to say monitoring the jobs data in the US isn't important, but the true imperial evidence might not become clear for some time and I am more interested in this week's jobless claims to see the degree of consistency in both accuracy and consistency as a better indication of how bad the situation is at present.

Remember to subscribe to the Amplify Trading YouTube channel for daily market updates and best wishes to you and your family at this time.

Anthony Cheung

Head of Market Analysis

Twitter: @AWMCheung

Instagram: @amplify_ant

CALENDAR HIGHLIGHTS

Monday: SP CPI, Retail Sales, Business Confidence, GE CPI, EU Consumer Confidence, Business Climate, Industrial/Services Sentiment, UK Nationwide HPI, Mortgage Lending/Approvals, M4 Money Supply, US Pending Homes Sales, Dallas Fed Manufacturing Business Index

Tuesday: JN Industrial Production, Unemployment Rate, Retail Sales, Housing Starts, CN Manufacturing/Non-Manufacturing PMI, AU ANZ Business Confidence, GE Unemployment Rate/Change, Import Price Index, FR CPI, IT CPI/PPI, 5/10-yr Auctions, SP GDP, EU CPI, UK GDP, Current Account, Business Investment, GfK Consumer Confidence, US Chicago PMI, CB Consumer Confidence, Weekly API Inventories, CA GDP

Wednesday: JN Manufacturers Index, Manufacturing PMI, CN Caixin Manufacturing PMI, AU Manufacturing PMI, Building Approvals, Commodity Prices, SP/IT/GE/EU Manufacturing PMI (F), GE Retail Sales, 5-yr Auction, EU Unemployment Rate, UK Manufacturing PMI, US ADP Employment Change, Manufacturing PMI, ISM Manufacturing PMI, Weekly DoE Inventories, CA RBC Manufacturing PMI, Fed's George Speaks

Thursday: JN 10-yr Auction, SP Unemployment Rate, 3/5/10-yr Auctions, EU PPI, UK Construction PMI, US Challenger Job Cuts, Weekly Jobless Claims, Trade Balance, Factory Orders, ISM-NY Index, Total Vehicle Sales, CA Trade Balance, Fed's George Speaks

Friday: JN Services PMI, AU Services PM, Retail Sales, SP/FR/GE/EU Services PMI (F), SP Industrial Production, FR Govt Budget Balance, IT Public Deficit, EU Retail Sales, US Non-Farm Payrolls, Unemployment Rate, Average Hourly Earnings, Services PMI, ISM Non-Manufacturing PMI

Find out more about Amplify Trading HERE.

This isn't to say monitoring the jobs data in the US isn't important, but the true imperial evidence might not become clear for some time and I am more interested in this week's jobless claims to see the degree of consistency in both accuracy and consistency as a better indication of how bad the situation is at present.

Remember to subscribe to the Amplify Trading YouTube channel for daily market updates and best wishes to you and your family at this time.

Anthony Cheung

Head of Market Analysis

Twitter: @AWMCheung

Instagram: @amplify_ant

CALENDAR HIGHLIGHTS

Monday: SP CPI, Retail Sales, Business Confidence, GE CPI, EU Consumer Confidence, Business Climate, Industrial/Services Sentiment, UK Nationwide HPI, Mortgage Lending/Approvals, M4 Money Supply, US Pending Homes Sales, Dallas Fed Manufacturing Business Index

Tuesday: JN Industrial Production, Unemployment Rate, Retail Sales, Housing Starts, CN Manufacturing/Non-Manufacturing PMI, AU ANZ Business Confidence, GE Unemployment Rate/Change, Import Price Index, FR CPI, IT CPI/PPI, 5/10-yr Auctions, SP GDP, EU CPI, UK GDP, Current Account, Business Investment, GfK Consumer Confidence, US Chicago PMI, CB Consumer Confidence, Weekly API Inventories, CA GDP

Wednesday: JN Manufacturers Index, Manufacturing PMI, CN Caixin Manufacturing PMI, AU Manufacturing PMI, Building Approvals, Commodity Prices, SP/IT/GE/EU Manufacturing PMI (F), GE Retail Sales, 5-yr Auction, EU Unemployment Rate, UK Manufacturing PMI, US ADP Employment Change, Manufacturing PMI, ISM Manufacturing PMI, Weekly DoE Inventories, CA RBC Manufacturing PMI, Fed's George Speaks

Thursday: JN 10-yr Auction, SP Unemployment Rate, 3/5/10-yr Auctions, EU PPI, UK Construction PMI, US Challenger Job Cuts, Weekly Jobless Claims, Trade Balance, Factory Orders, ISM-NY Index, Total Vehicle Sales, CA Trade Balance, Fed's George Speaks

Friday: JN Services PMI, AU Services PM, Retail Sales, SP/FR/GE/EU Services PMI (F), SP Industrial Production, FR Govt Budget Balance, IT Public Deficit, EU Retail Sales, US Non-Farm Payrolls, Unemployment Rate, Average Hourly Earnings, Services PMI, ISM Non-Manufacturing PMI

Find out more about Amplify Trading HERE.

The Market Maker daily

e-newsletter and weekly podcast

99% said it helped them gain better knowledge of markets

99% said it helped them gain better knowledge of markets  70% said it helped them prepare for a job interview

70% said it helped them prepare for a job interview  Top 5% most followed podcasts globally

Top 5% most followed podcasts globally  Top 5% most shared globally in 2022

Top 5% most shared globally in 2022  Listened to in 84 countries world-wide

Listened to in 84 countries world-wide

Useful Links

EMPLOYERS

UNIVERSITIES

Contact

Sign up to our e-newsletter for the latest market news and careers support.

Sign up to our e-newsletter for the latest market news and careers support.

© Amplify Trading LTD (REG NO: 06798566) VAT: GB947568566. Registered England and Wales.

Useful Links

STUDENTS

EMPLOYERS

UNIVERSITIES

Contact

-

Amplify Trading, 18 St Swithlin’s Ln, London EC4N 8AD

-

+44 (0) 203 372 8415

+44 (0) 203 372 8415

-

info@amplifyme.com

info@amplifyme.com

Sign up to our e-newsletter for the latest market news and careers support.

© Amplify Trading LTD (REG NO: 06798566) VAT: GB947568566. Registered England and Wales.