MACRO MENU: 27th - 31st July 2020

27 JULY 2020 | Careers

EARNINGS SEASON HITS TOP GEAR

During the upcoming week, 192 S&P 500 companies (including 12 Dow 30 components) are scheduled to report results for the second quarter. Focus again will be on the mega-cap tech names with Amazon, Apple and Alphabet all due to report after-market on Thursday.

To date, 26% of the companies in the S&P 500 have reported actual results for Q2 and in terms of earnings, the percentage of companies reporting actual EPS above estimates (81%) is above the five-year average, according to Factset.

During the upcoming week, 192 S&P 500 companies (including 12 Dow 30 components) are scheduled to report results for the second quarter. Focus again will be on the mega-cap tech names with Amazon, Apple and Alphabet all due to report after-market on Thursday.

To date, 26% of the companies in the S&P 500 have reported actual results for Q2 and in terms of earnings, the percentage of companies reporting actual EPS above estimates (81%) is above the five-year average, according to Factset.

Amir Khadr - Head of Technology

Amir Khadr - Head of Technology

Meanwhile, in the UK look out for numbers from GlaxoSmithKline, AstraZenca, Shell and Lloyds, while in mainland Europe highlights include SAP, Volkswagen, BASF, LVMH, Total and Sanofi.

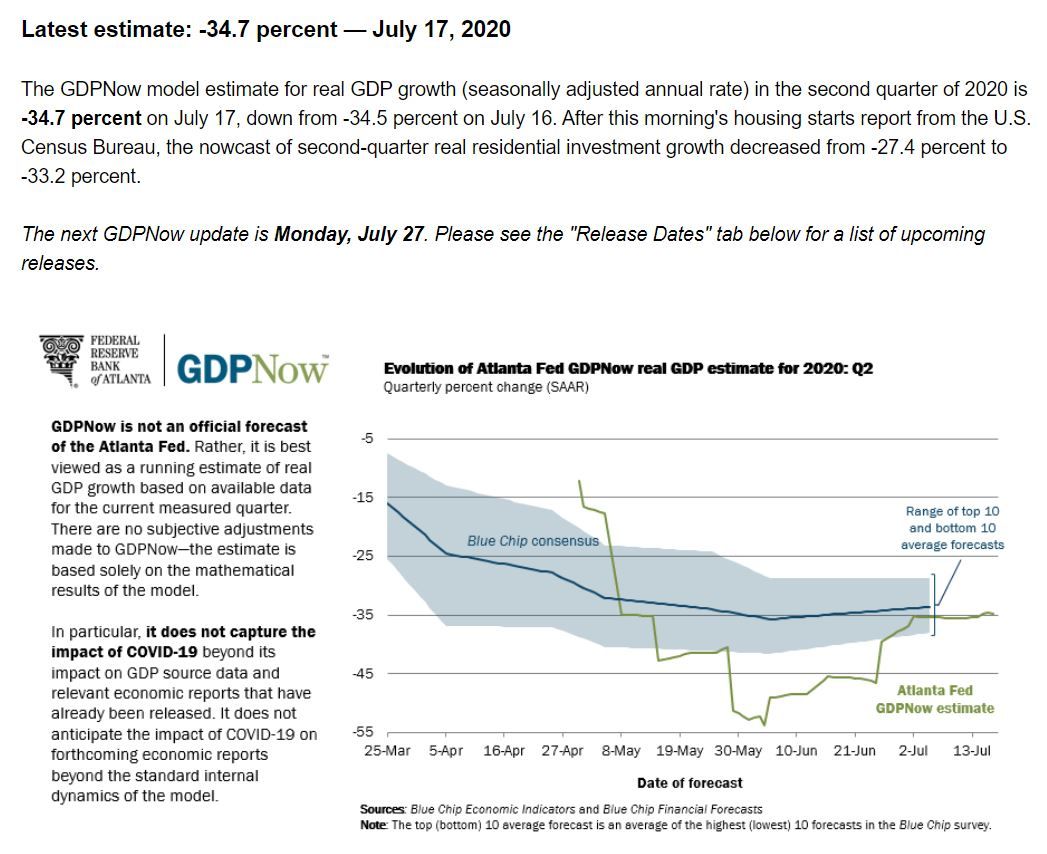

A MOMENT IN HISTORY

The release of the Advanced reading of US Q2 GDP this Thursday should mark an historic moment in history, as expectations are that the US economy will contract by 34%, making evidently clear the devastating impact the global pandemic has had on the world's largest economy. Despite this, markets are likely to brush over the dramatic headline and remain more concerned by the shape of the economic recovery.

A MOMENT IN HISTORY

The release of the Advanced reading of US Q2 GDP this Thursday should mark an historic moment in history, as expectations are that the US economy will contract by 34%, making evidently clear the devastating impact the global pandemic has had on the world's largest economy. Despite this, markets are likely to brush over the dramatic headline and remain more concerned by the shape of the economic recovery.

As such, attention will remain on the daily COVID updates and with the latest FOMC meeting (Weds) likely to repeat the Bank's readiness to do more in future if needed.

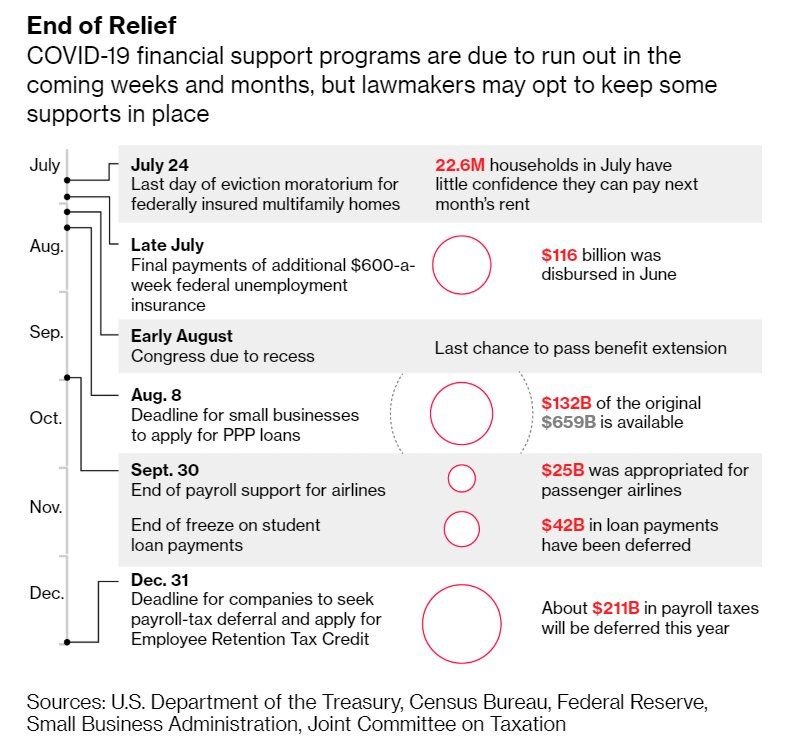

THE CLOCK IS TICKING

Business Insider reported this weekend that Republicans are proposing scaling back the $600 weekly federal boost to state unemployment benefits that Congress approved in March to an estimated $200 a week. But the move could shed 3.4 million jobs from the American economy, according to an estimate published Friday from the Economic Policy Institute, a left-leaning think-tank.

The enhanced jobless benefits (received by more than 20 million Americans) will expire on Friday and comes alongside the end of the federal eviction moratorium putting some 12 million renters at risk of eviction.

THE CLOCK IS TICKING

Business Insider reported this weekend that Republicans are proposing scaling back the $600 weekly federal boost to state unemployment benefits that Congress approved in March to an estimated $200 a week. But the move could shed 3.4 million jobs from the American economy, according to an estimate published Friday from the Economic Policy Institute, a left-leaning think-tank.

The enhanced jobless benefits (received by more than 20 million Americans) will expire on Friday and comes alongside the end of the federal eviction moratorium putting some 12 million renters at risk of eviction.

This all of course comes amid a coronavirus situation where US cases increased close to 75,000, the second highest daily count on record this weekend and deaths exceeded 1000 for the fourth time this week.

As such, eyes remain on Capitol Hill and given the implications of remaining at an impasse I would expect a stop gap resolution will inevitably be found at the last moment paving the way for the announcement of a new $1trl stimulus package, a necessary expense to keep the stimulus hungry markets buoyant for the time being.

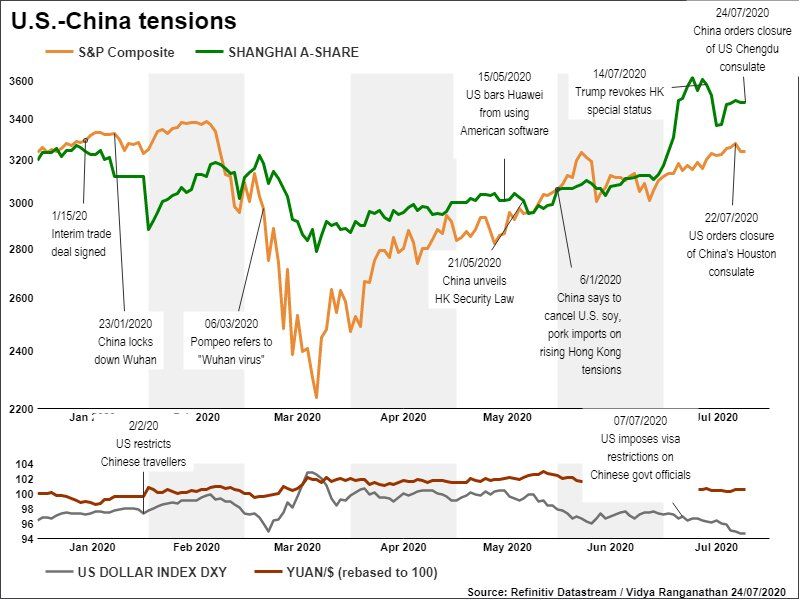

COMMUNIST CHINA & THE FREE WORLD'S FUTURE

This was in fact the title of the speech delivered by the US Secretary of State Mike Pompeo last week not the strap line to the latest Tom Cruise movie. The combative tone saw a new low for US-China relations following the US order to close the Chinese consulate in Houston. Although rehoritic on both sides has ramped up significantly since the security law change in Hong Kong, what else were we to expect with less than 100 days to go until the US election?

The latest events certainly drew some attention last week but were not the sole catalyst for the drop in US stocks with the major indices (especially) the Nasdaq ripe for a short-term bout of profit taking after retesting record highs at breakneck speed. Nonetheless, vigilance remains the remedy to navigate the ongoing tensions so we remain alert for any further developments as they evolve.

I'll be sharing more daily insights and analysis throughout the week, so don't forget to subscribe to the Amplify Trading YouTube channel and follow me on Twitter @AWMCheung.

Find out more about Amplify Trading and our training programmes.

As such, eyes remain on Capitol Hill and given the implications of remaining at an impasse I would expect a stop gap resolution will inevitably be found at the last moment paving the way for the announcement of a new $1trl stimulus package, a necessary expense to keep the stimulus hungry markets buoyant for the time being.

COMMUNIST CHINA & THE FREE WORLD'S FUTURE

This was in fact the title of the speech delivered by the US Secretary of State Mike Pompeo last week not the strap line to the latest Tom Cruise movie. The combative tone saw a new low for US-China relations following the US order to close the Chinese consulate in Houston. Although rehoritic on both sides has ramped up significantly since the security law change in Hong Kong, what else were we to expect with less than 100 days to go until the US election?

The latest events certainly drew some attention last week but were not the sole catalyst for the drop in US stocks with the major indices (especially) the Nasdaq ripe for a short-term bout of profit taking after retesting record highs at breakneck speed. Nonetheless, vigilance remains the remedy to navigate the ongoing tensions so we remain alert for any further developments as they evolve.

I'll be sharing more daily insights and analysis throughout the week, so don't forget to subscribe to the Amplify Trading YouTube channel and follow me on Twitter @AWMCheung.

Find out more about Amplify Trading and our training programmes.

I'll be sharing more daily insights and analysis throughout the week, so don't forget to subscribe to the Amplify Trading YouTube channel and follow me on Twitter @AWMCheung.

Find out more about Amplify Trading and our training programmes.

Find out more about Amplify Trading and our training programmes.

The Market Maker daily

e-newsletter and weekly podcast

99% said it helped them gain better knowledge of markets

99% said it helped them gain better knowledge of markets  70% said it helped them prepare for a job interview

70% said it helped them prepare for a job interview  Top 5% most followed podcasts globally

Top 5% most followed podcasts globally  Top 5% most shared globally in 2022

Top 5% most shared globally in 2022  Listened to in 84 countries world-wide

Listened to in 84 countries world-wide

Useful Links

EMPLOYERS

UNIVERSITIES

Contact

Sign up to our e-newsletter for the latest market news and careers support.

Sign up to our e-newsletter for the latest market news and careers support.

© Amplify Trading LTD (REG NO: 06798566) VAT: GB947568566. Registered England and Wales.

Useful Links

STUDENTS

EMPLOYERS

UNIVERSITIES

Contact

-

Amplify Trading, 18 St Swithlin’s Ln, London EC4N 8AD

-

+44 (0) 203 372 8415

+44 (0) 203 372 8415

-

info@amplifyme.com

info@amplifyme.com

Sign up to our e-newsletter for the latest market news and careers support.

© Amplify Trading LTD (REG NO: 06798566) VAT: GB947568566. Registered England and Wales.