Macro menu: 10 - 14 august 2020

09 AUG 2020 | Careers

One step forward, two steps back

US President Donald Trump announced four executive actions on Saturday:

Weekend indications suggest US stock futures will see a gap up of approximiately 0.25% on the back of the news as the announcement averts the worst case scenario that could have severely hampered the on-going economic recovery, potentially impacting 10's of millions of Americans at risk of financial harm and eviction. However, despite the initial relief in markets the intervention by the President does not come without consequence.

The moves could well jeopardize negotiations with Congressional Democrats over an additional coronavirus relief package with the two sides still trillions of dollars apart in talks last week ($1 - $3.5trl) and although the expansion and prolonging of fiscal support may help Trump in his election quest - all good things must come to an end eventually.

US President Donald Trump announced four executive actions on Saturday:

- Provide $400 a week in jobless benefits - down from $600 authorized by a Congressional stimulus bill in March

- US Treasury to allow companies to defer payroll taxes for Americans making less than $100,000 a year from Sept. 1 through Dec. 31

- Defer student loans and interest

- Extend the federal eviction moratorium

Weekend indications suggest US stock futures will see a gap up of approximiately 0.25% on the back of the news as the announcement averts the worst case scenario that could have severely hampered the on-going economic recovery, potentially impacting 10's of millions of Americans at risk of financial harm and eviction. However, despite the initial relief in markets the intervention by the President does not come without consequence.

The moves could well jeopardize negotiations with Congressional Democrats over an additional coronavirus relief package with the two sides still trillions of dollars apart in talks last week ($1 - $3.5trl) and although the expansion and prolonging of fiscal support may help Trump in his election quest - all good things must come to an end eventually.

A common pattern in politics is that there is nothing quite like a 'cliff-edge' scenario to sharpen the mind and get deals done, whether it be Brexit legislation or further US fiscal stimulus. While Friday's better than expected Non-Farm Payrolls report (1.763mln vs Exp. 1.635mln) is a welcome statistic for the real economy, for negotiations on Capitol Hill it may well just act as more reason to drag out discussions further, a prospect that could start to weigh on sentiment as the week progresses.

Despite this logic, the Federal Reserve is still a far from changing course anytime soon and inevitable in a politically sensitive year one would imagine that further US stimulus is all but inevitable. As such, any pull backs in US stocks I still see as buying opportunities upon strategic technical points of entry, alongside a thorough assessment of the status of US-China trade talks and COVID-19.

Amir Khadr - Head of TechnologyDespite this logic, the Federal Reserve is still a far from changing course anytime soon and inevitable in a politically sensitive year one would imagine that further US stimulus is all but inevitable. As such, any pull backs in US stocks I still see as buying opportunities upon strategic technical points of entry, alongside a thorough assessment of the status of US-China trade talks and COVID-19.

A common rule in index trading is to be aware of the weightings of the largest constituents, an approach that has never been more important than today.

Here's a great graphic via Bank of America to show that despite the lack of breadth in the rise to all-time highs in US stocks nothing else really matters for now other than the fab five: AMZN, AAPL, MSFT, GOOGL and FB.

Here's a great graphic via Bank of America to show that despite the lack of breadth in the rise to all-time highs in US stocks nothing else really matters for now other than the fab five: AMZN, AAPL, MSFT, GOOGL and FB.

Trump closes the gap

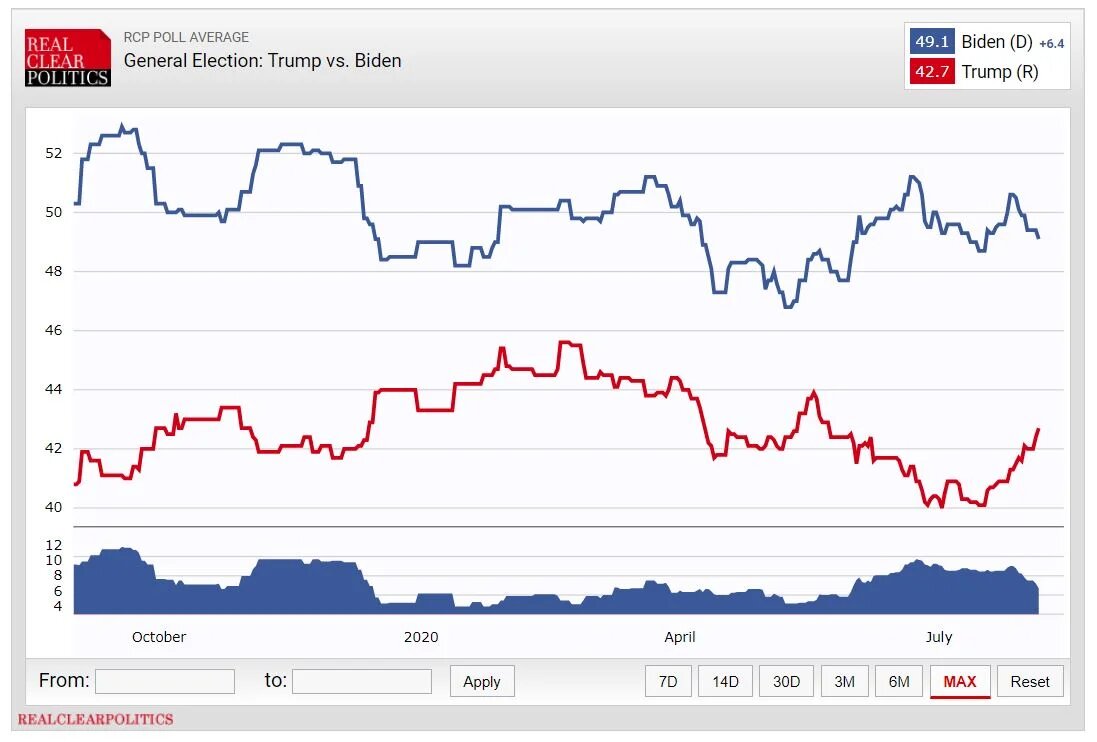

As new COVID case numbers across the sunbelt states in the US appear to have peaked the US election polls have quietly converged by some 4 points since the worst point of the outbreak four weeks ago, with the Biden lead now being reduced to just 6.4 points from +10 in the RCP poll average.

As new COVID case numbers across the sunbelt states in the US appear to have peaked the US election polls have quietly converged by some 4 points since the worst point of the outbreak four weeks ago, with the Biden lead now being reduced to just 6.4 points from +10 in the RCP poll average.

Biden is set to announce his running mate this week before the Democratic convention on the 17th August. The bookies favourite is California senator and attorney general Kamala Harris (10/11) with his former colleague and the national security adviser to the Obama administration, Susan Rice, a close second (7/4).

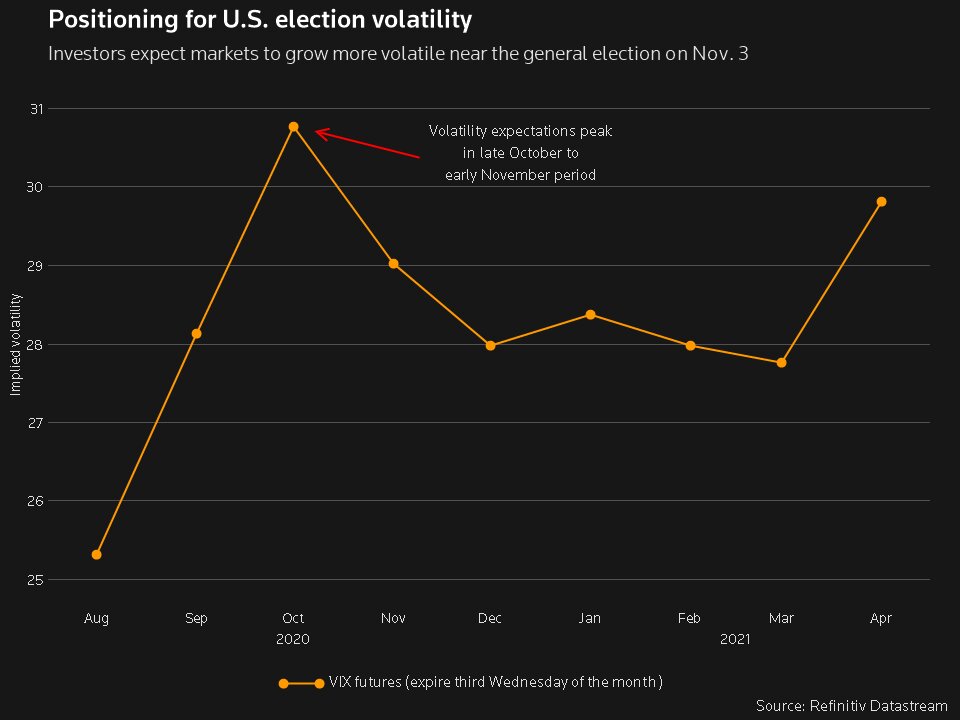

Although election fever is still yet to take hold as the world remains on COVID watch, some investors are moving to hedge portfolios against volatility around the Nov. 3 election.

The implied volatility rise looks especially steep, given the VIX itself has eased to 5-month lows. The spread between August and October VIX futures is at 5.5 points, the widest since the contracts began trading as focus may be less on the outcome and more on possible delays in tallying results, due to the widespread use of mail ballots this year, according to Reuters.

Although election fever is still yet to take hold as the world remains on COVID watch, some investors are moving to hedge portfolios against volatility around the Nov. 3 election.

The implied volatility rise looks especially steep, given the VIX itself has eased to 5-month lows. The spread between August and October VIX futures is at 5.5 points, the widest since the contracts began trading as focus may be less on the outcome and more on possible delays in tallying results, due to the widespread use of mail ballots this year, according to Reuters.

TikTok... time is running out

US Trade Representative Robert Lighthizer and Chinese Vice Premier Liu He will review the implementation of their Phase 1 trade deal and likely air mutual grievances during a video conference schduled for Saturday 15. August.

So far, China has come woefully short to living up to its commitments in purchasing $200bln of US goods over a two year period and last week saw a distinct escalation on the tech front over TikTok and WeChat, while the President also imposed restrictions on 11 Hong Kong and Chinese officials, including Carrie Lam, Hong Kong's chief executive, and Luo Huining, mainland China's top official in the city. The call doesn't take place until Saturday but the forecast is for plenty of turbulence over the coming days as the White House strategy has nearly always been to head into talks on the front foot.

I'll be sharing more daily analysis throughout the week, so don't forget to subscribe to the Amplify trading YouTube Channel and follow me on Twitter @AWMCheung.

Click the button below to find out more about Amplify Trading's training programmes.

Calendar highlights via newsquawk

MONDAY:

TUESDAY:

WEDNESDAY:

THURSDAY:

FRIDAY:

SATURDAY:

US Trade Representative Robert Lighthizer and Chinese Vice Premier Liu He will review the implementation of their Phase 1 trade deal and likely air mutual grievances during a video conference schduled for Saturday 15. August.

So far, China has come woefully short to living up to its commitments in purchasing $200bln of US goods over a two year period and last week saw a distinct escalation on the tech front over TikTok and WeChat, while the President also imposed restrictions on 11 Hong Kong and Chinese officials, including Carrie Lam, Hong Kong's chief executive, and Luo Huining, mainland China's top official in the city. The call doesn't take place until Saturday but the forecast is for plenty of turbulence over the coming days as the White House strategy has nearly always been to head into talks on the front foot.

I'll be sharing more daily analysis throughout the week, so don't forget to subscribe to the Amplify trading YouTube Channel and follow me on Twitter @AWMCheung.

Click the button below to find out more about Amplify Trading's training programmes.

Calendar highlights via newsquawk

MONDAY:

- DATA: Chinese Inflation

- SPEAKERS: Fed’s Evans (Non-voter)

- EARNINGS: Occidental Petroleum Corp, Marriott International Inc

- HOLIDAYS: Japanese Mountain Day - Market Holiday

TUESDAY:

- DATA: UK Labour Market Report, German ZEW Survey

- SPEAKERS: Fed’s Daly (Non-voter)

- SUPPLY: UK and US

- EARNINGS: Sysco

WEDNESDAY:

- DATA: UK GDP Prelim, US CPI

- EVENTS: RBNZ Rate Decision

- SPEAKERS: Fed’s Kaplan (Voter), Fed’s Rosengren (Non-voter), Fed’s Daly (Non-voter)

- SUPPLY: UK, Germany, and US

- EARNINGS: Cisco Systems, E.ON

THURSDAY:

- DATA: Australian Labour Force Report, US Import/Export Prices and Initial Jobless Claims

- SUPPLY: US

- EARNINGS: Applied Materials, Deutsche Telekom, Swisscom, RWE, Thyssenkrupp, Tui

FRIDAY:

- DATA: Chinese Retail Sales and Industrial Data, EZ Employment and GDP (2nd), US Retail Sales, Industrial Production and University of Michigan Survey

- EVENTS: S&P and Fitch on Hungary, Moody’s on Ireland

- SPEAKERS: RBA Governor Lowe

SATURDAY:

- EVENTS: US-China Meeting

The Market Maker daily

e-newsletter and weekly podcast

99% said it helped them gain better knowledge of markets

99% said it helped them gain better knowledge of markets  70% said it helped them prepare for a job interview

70% said it helped them prepare for a job interview  Top 5% most followed podcasts globally

Top 5% most followed podcasts globally  Top 5% most shared globally in 2022

Top 5% most shared globally in 2022  Listened to in 84 countries world-wide

Listened to in 84 countries world-wide

Useful Links

EMPLOYERS

UNIVERSITIES

Contact

Sign up to our e-newsletter for the latest market news and careers support.

Sign up to our e-newsletter for the latest market news and careers support.

© Amplify Trading LTD (REG NO: 06798566) VAT: GB947568566. Registered England and Wales.

Useful Links

STUDENTS

EMPLOYERS

UNIVERSITIES

Contact

-

Amplify Trading, 18 St Swithlin’s Ln, London EC4N 8AD

-

+44 (0) 203 372 8415

+44 (0) 203 372 8415

-

info@amplifyme.com

info@amplifyme.com

Sign up to our e-newsletter for the latest market news and careers support.

© Amplify Trading LTD (REG NO: 06798566) VAT: GB947568566. Registered England and Wales.